ILS One

ILS One is a full lifecycle platform for Institutional Investors, Reinsurers, Brokers and Agents to transform insurance-linked securities into programmable on-chain instruments.

Vulc... Bond (US)

Leverage the opportunities presented by insurance risks related to vulcanic activities.

Redemption in 26 days

26 days

+14%

Forest Fires Bond

Leverage the opportunities presented by insurance risks related to climate change.

Redemption in 42 days

42 days

+12%

Floodings Bond

Leverage the opportunities presented by insurance risks related to floodings damage.

Redemption in 30 days

30 days

+18%

Hurricane Bond

Leverage the opportunities presented by insurance risks related to hurricanes.

Redemption in 12 days

12 days

+22%

Trusted by institutional leaders

Who is it for

Built for every participant in the ILS value chain

Institutional Investors

Challenge

Illiquid, opaque ILS exposure with limited secondary market options

Solution

24/7 liquidity, full transparency, and programmable positions

Reinsurers

Challenge

Manual processes, slow settlement cycles, fragmented data

Solution

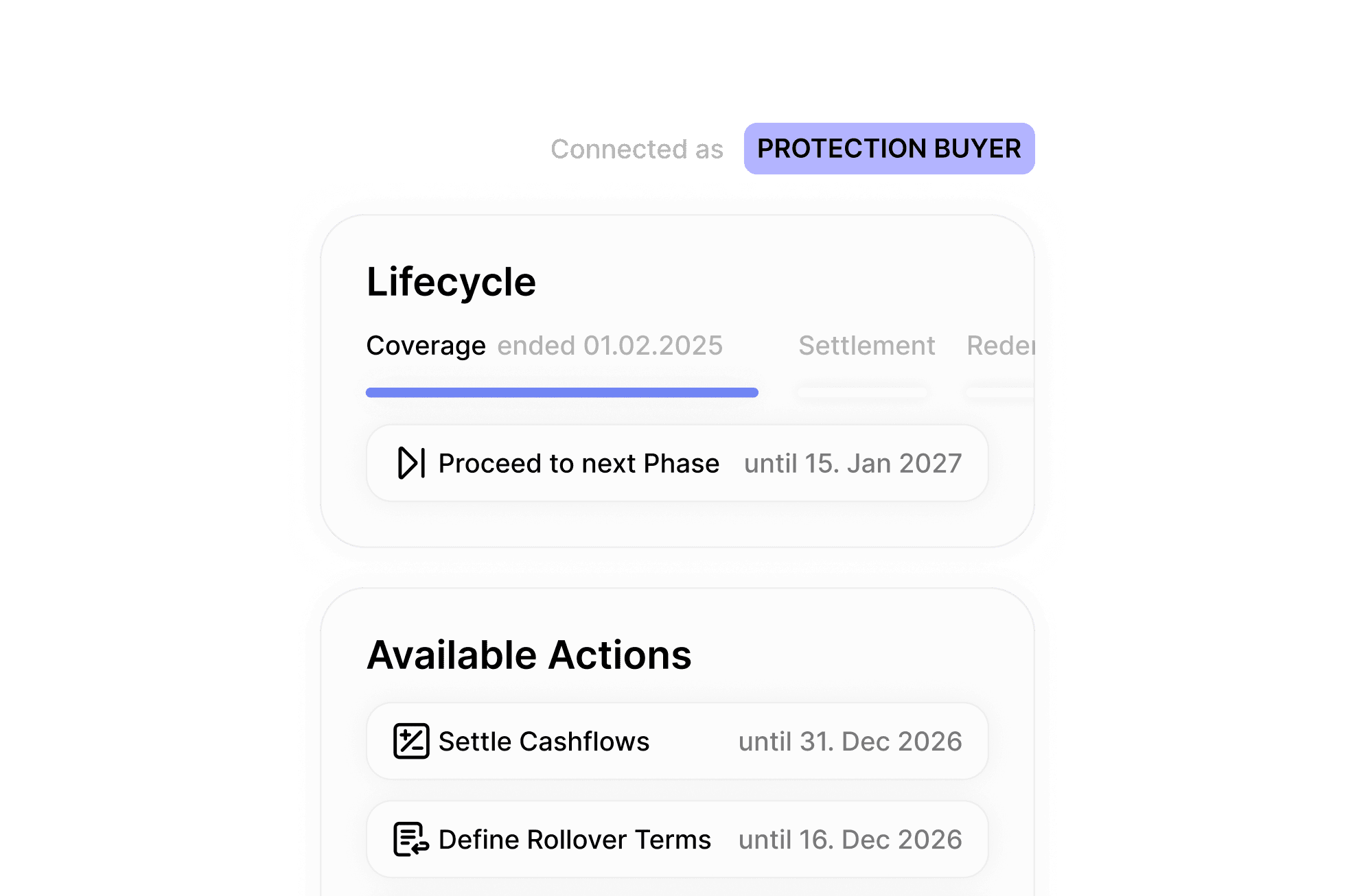

Automated lifecycle management and instant settlement

Brokers

Challenge

Fragmented intermediaries and disconnected workflows

Solution

Single platform with streamlined deal structuring

Agents

Challenge

Limited access to capital and complex deal structuring

Solution

Direct market access with programmable agreements

Programmable Reinsurance in Action

Experience what efficiency feels like

Upload animation to: /public/animations/highlights/governance.mp4

Institutional-grade control for critical actions. Define approval thresholds, segregate roles and enforce governance directly on-chain.

A full-lifecycle ILS platform

From structuring to settlement — on one programmable stack

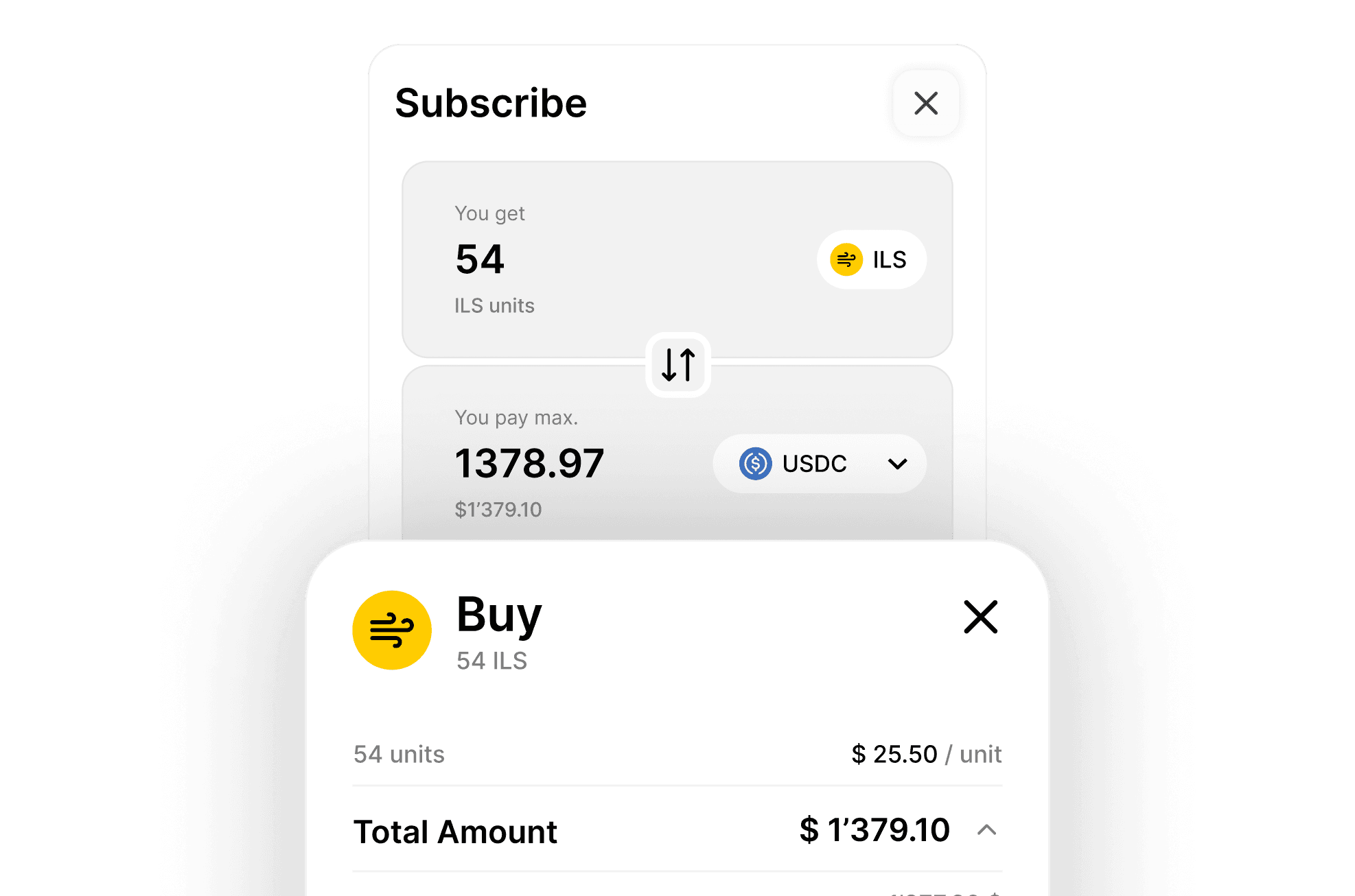

Institutional Marketplace

Trade ILS positions without breaking structure

Enable controlled secondary trading of ILS agreements while preserving governance, compliance and transparency.

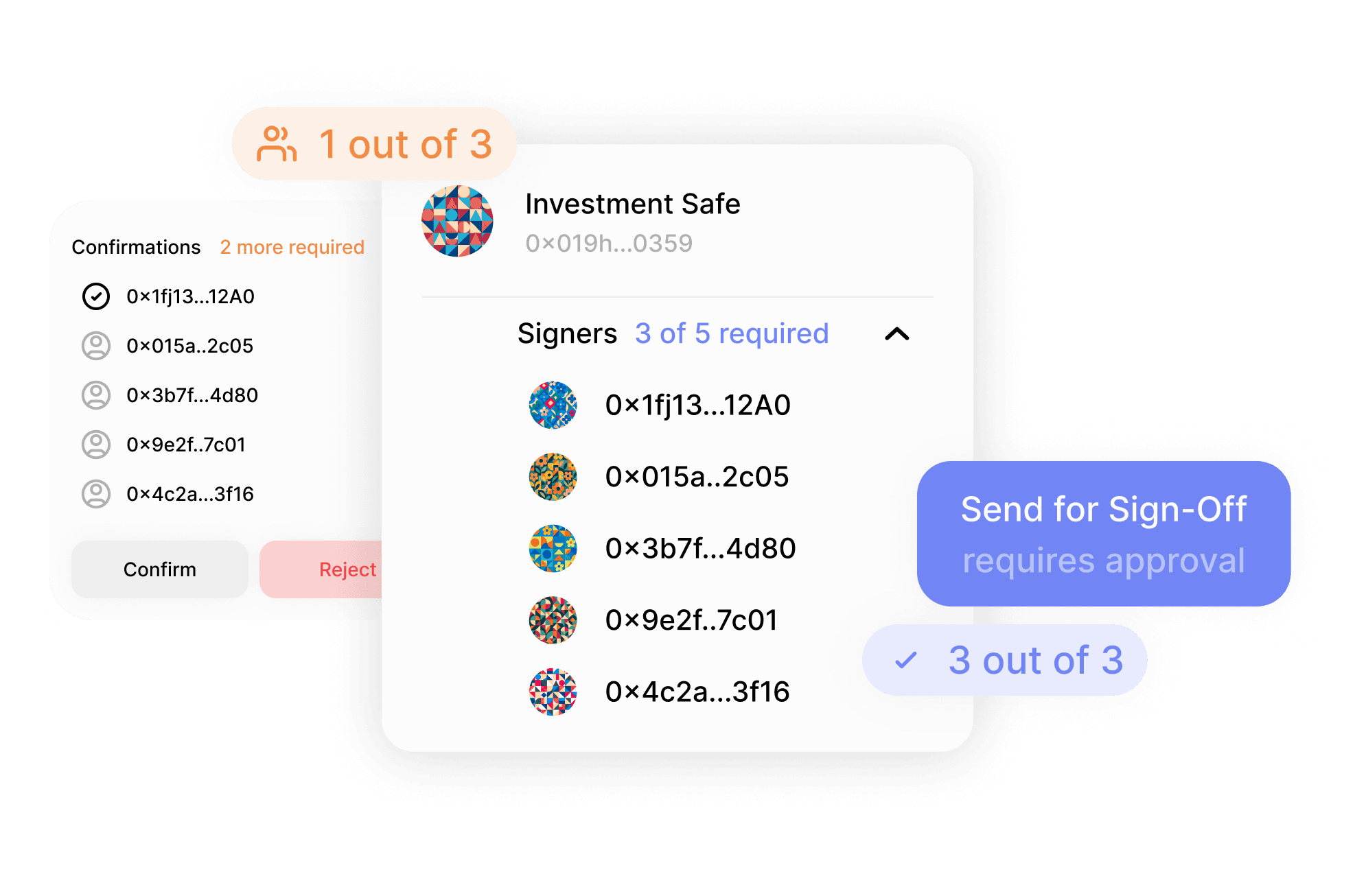

Institutional Transactions

Secure every transfer through multi-signature control

Self-custodial, role-based wallets designed for institutional workflows — not retail crypto UX.

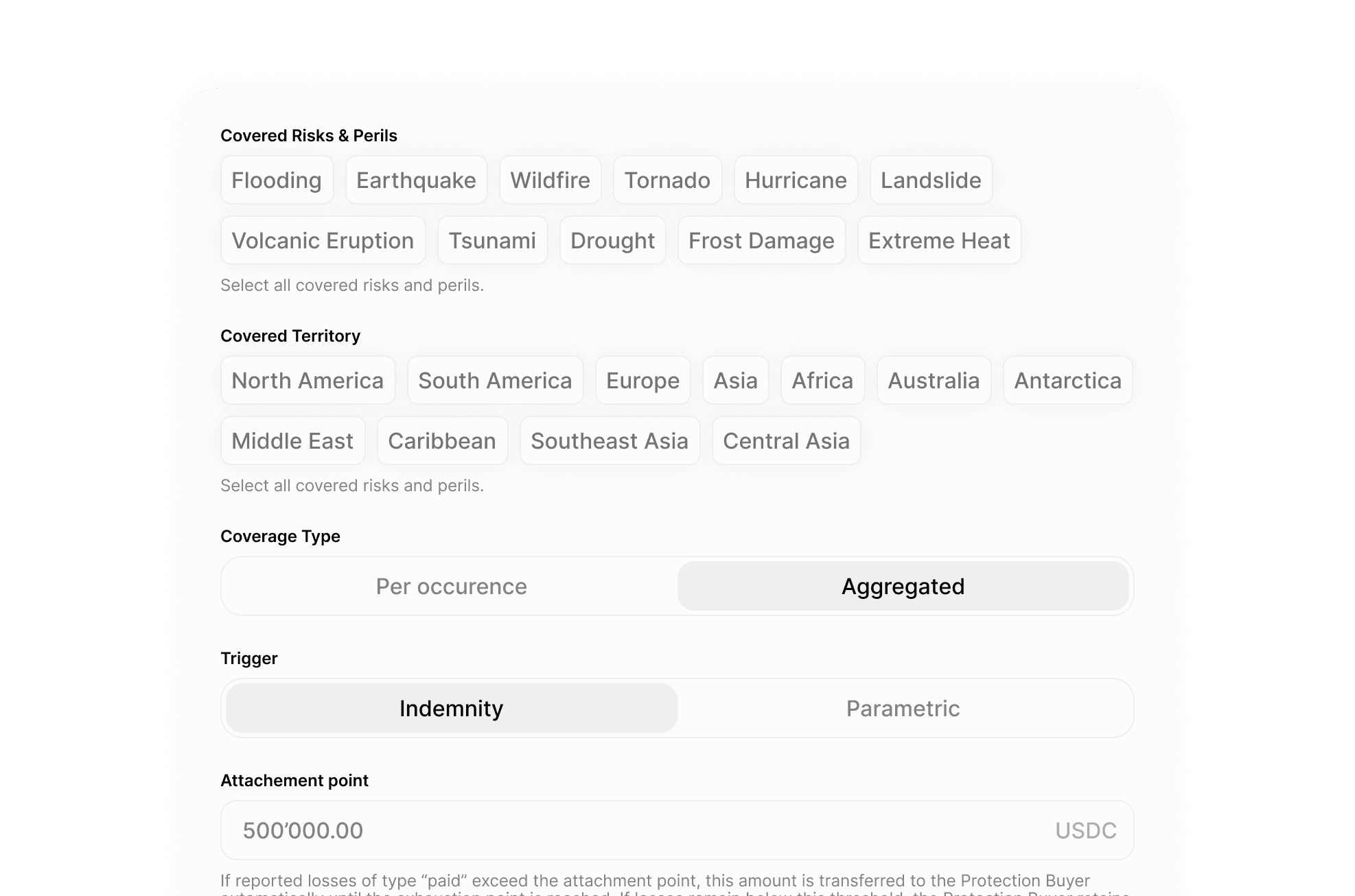

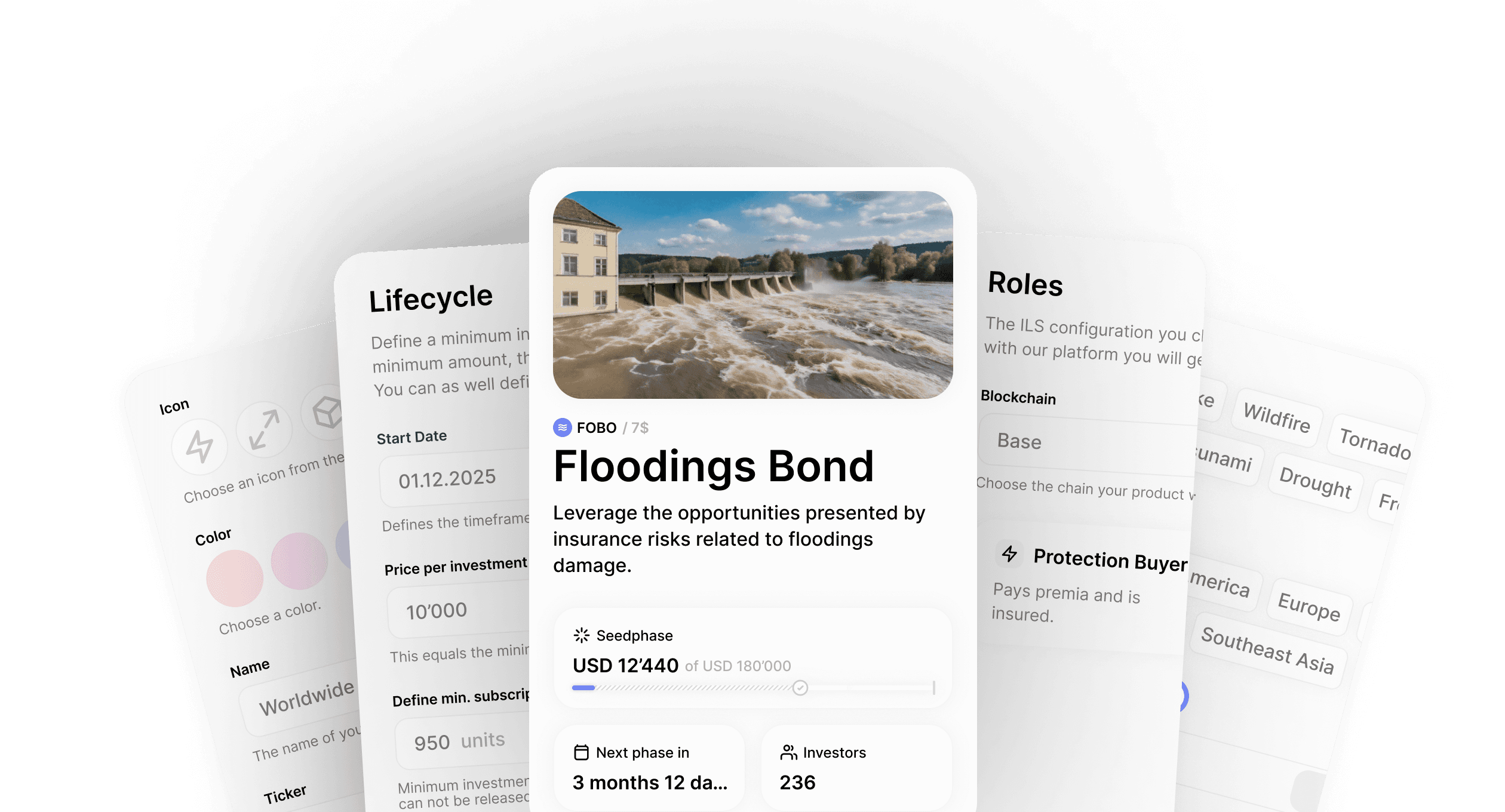

Product Configurator

Build deals from click-through templates

Turn legal agreements into executable smart contracts. Define triggers, roles, termination logic, run-off mechanics and settlement rules — without bespoke development.

Role-Based Interactions

Pre-configured actions by role

Assign and enforce who can do what — directly at protocol level.

Product in Numbers

Real operational impact, measurable results

ILS Vault Engine

A modular smart-contract architecture built for long-dated, multi-party financial products.

Down from 96 hours to 12 seconds

Reduced to 1% from 10% operational overhead

Deposit, Redeem or Trade anytime

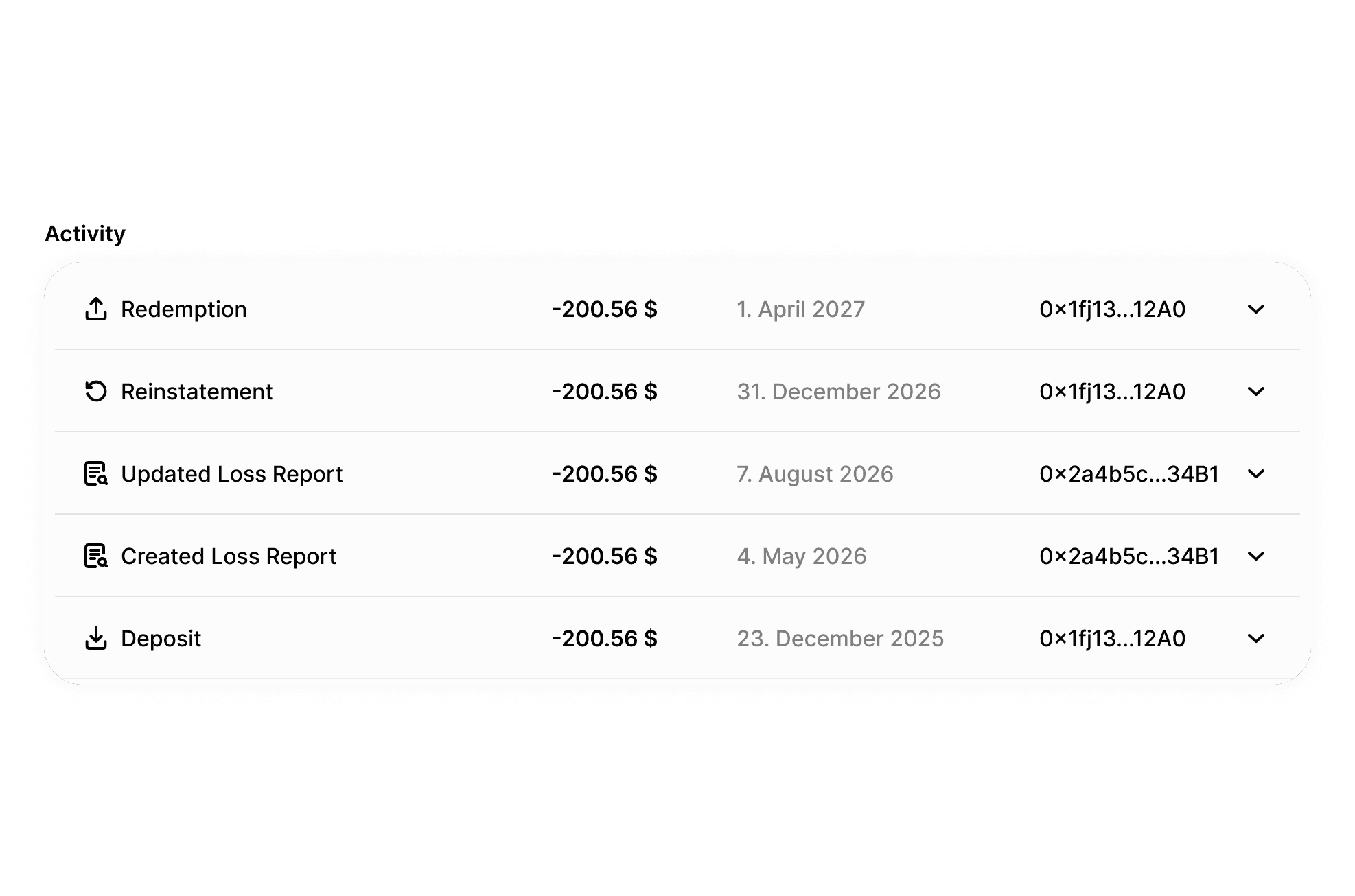

Full on-chain traceability

Performance Comparison

Digital infrastructure for ILS

Built to mirror legal reality — not disrupt it

ILS One is a smart-contract-based infrastructure that faithfully reflects existing legal structures while automating collateral flows, reporting and settlement.

Smart-Contract Templates

Create legally aligned agreements through guided click-through templates and deploy them on-chain with built-in controls.

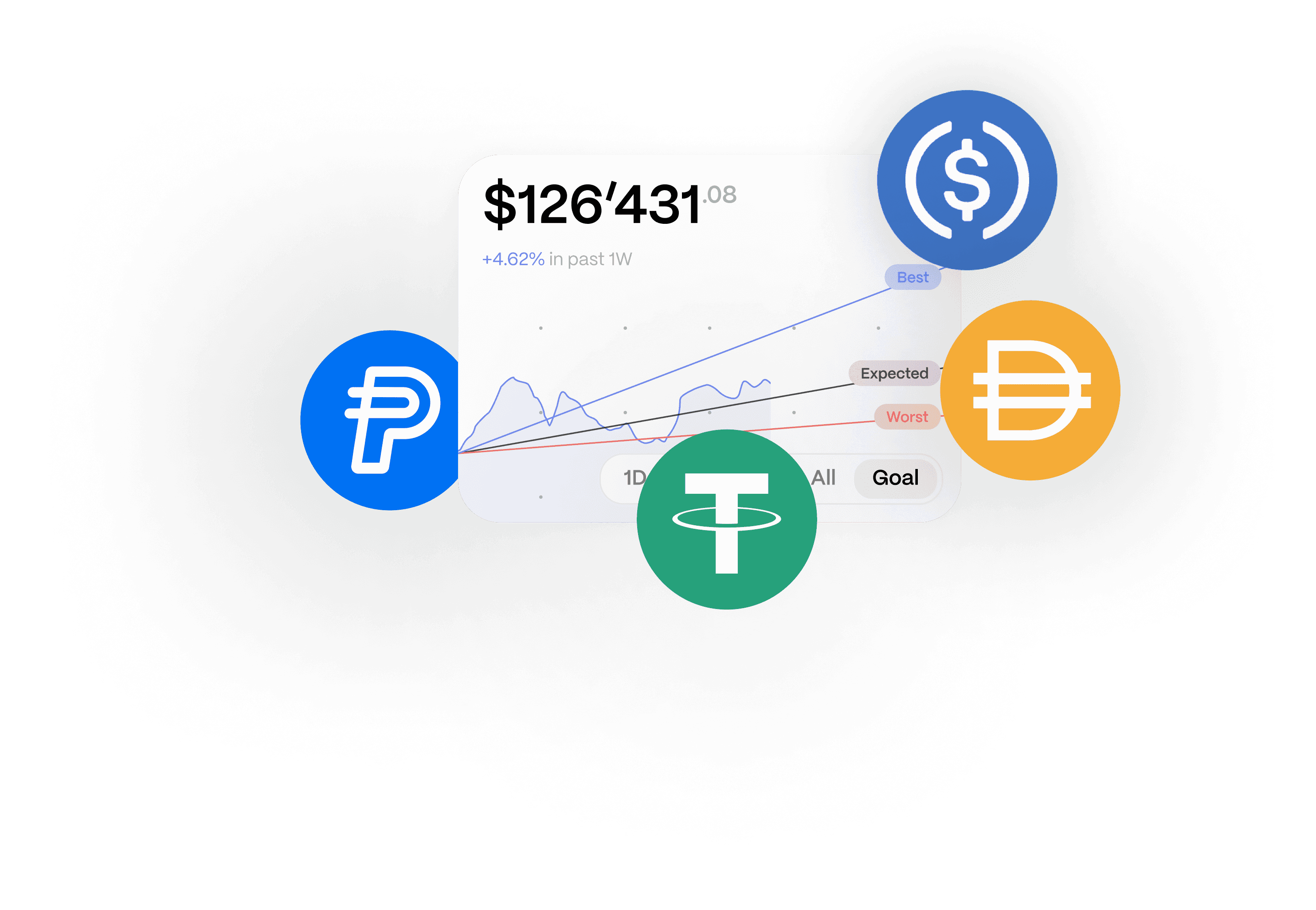

Institutional DeFi, selectively applied

Integrate with Ethereum-based blockchains (EVM-compatible networks), stablecoins and institutional yield strategies — where they add real value.

Auditability by default

Every action, approval and cashflow is traceable, timestamped and verifiable on-chain.

Enterprise-grade security

Built for institutional trust. Verified by industry leaders.

Security is embedded at every layer — from audited smart contracts to continuous monitoring. We meet the standards institutions demand.

Tier-1 Security Audits

Smart contracts independently audited by leading blockchain security firms. Every line of code reviewed for vulnerabilities, logic errors and attack vectors. Audit reports available on request.

Regular Security Testing

Application and UI undergo comprehensive penetration testing by certified security professionals. OWASP Top 10 coverage and beyond.

Non-Custodial Architecture

Your assets remain in your control. ILS One never takes custody of funds — all transactions require your explicit multi-signature approval.

Multi-Signature Protection

Critical operations require multiple authorized signatures, preventing single points of failure. Configure approval thresholds to match your governance requirements.

On-Chain Transparency

All contract logic is verifiable on-chain. No hidden functions, no admin backdoors, no upgrade keys that could compromise your assets.

Continuous Monitoring

24/7 automated monitoring for anomalies, suspicious transactions and potential threats. Incident response procedures tested and documented.

Security is not a feature — it's the foundation of everything we build.

Pay-per-transaction.

No asset-based pricing. Fee structure is immutable once live.

Included

Core infrastructure at no cost

- Institutional Wallets

- Portfolio View

- Transaction Execution

- Multi-Signature Governance

- Role-Based Permissions

- On-Chain Audit Trail

Usage-Based

Pay only when you transact

- Product Publishing($1,000)

- Subscription Fee(0.25%)

- Redemption Fee(0.75%)

- Secondary Market Fee(1%)

- Renewal Fee(0.25%)

- Custom Setup(Let's talk)

Enterprise

For large organizations

- Volume discounts

- Dedicated support

- Custom integrations

- SLA guarantees

- White-label options

- Priority feature requests

Included

Core infrastructure at no cost

- Institutional Wallets

- Portfolio View

- Transaction Execution

- Multi-Signature Governance

- Role-Based Permissions

- On-Chain Audit Trail

Usage-Based

Pay only when you transact

- Product Publishing($1,000)

- Subscription Fee(0.25%)

- Redemption Fee(0.75%)

- Secondary Market Fee(1%)

- Renewal Fee(0.25%)

- Custom Setup(Let's talk)

Enterprise

For large organizations

- Volume discounts

- Dedicated support

- Custom integrations

- SLA guarantees

- White-label options

- Priority feature requests

The Team

Vision

To create the infrastructure layer that makes institutional-grade reinsurance accessible, transparent, and programmable for the global market.

Mission

We build the technical and operational foundations that enable insurance-linked securities to function as true digital instruments — without compromising on governance, compliance, or institutional standards.

Add a fun fact here

Team Member

Co-Founder & CEO

Add a fun fact here

Team Member

Co-Founder & CTO

Add a fun fact here

Team Member

Head of Product

Add a fun fact here

Team Member

Head of Engineering

Frequently Asked Questions

Everything you need to know before going on-chain